Historical House Style Windows

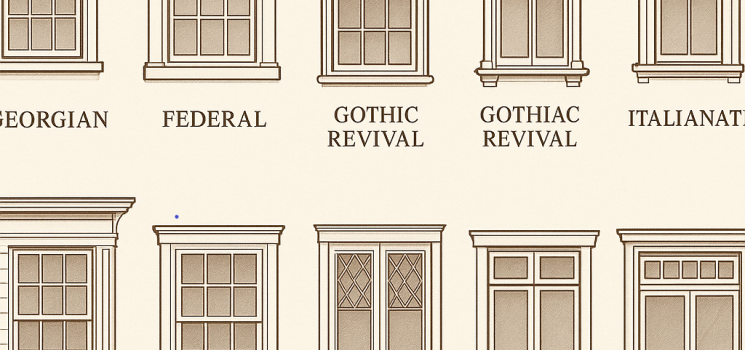

Historical house styles are often distinguished by their window designs. Below is a breakdown of historical house styles and their signature window types, which often reflect the architectural character and period details of the home:

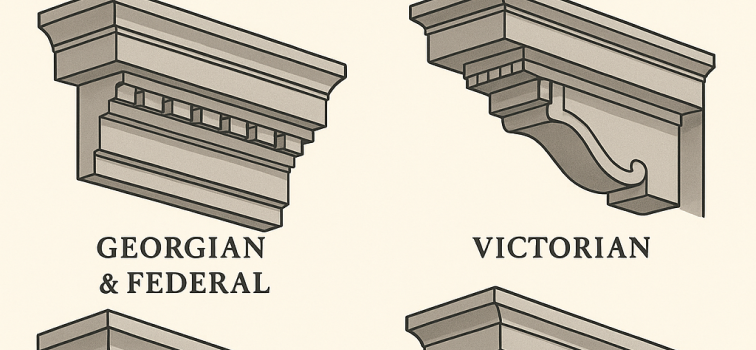

Georgian (1700–1780)

-

-

-

-

Windows: Double-hung sash windows with 6-over-6 or 9-over-9 panes.

-

Details: Symmetrical arrangement, flat arches or simple lintels, often with shutters.

-

Materials: Wood frames, usually painted white.

-

-

-

Federal (1780–1830)

-

-

-

-

Windows: Double-hung sash windows, typically 6-over-6.

-

Details: Frequently include fanlights over doors and elliptical or Palladian windows.

-

Shape: Taller and more slender than Georgian.

-

-

-

Greek Revival (1825–1860)

-

-

-

-

Windows: 6-over-6 or 9-over-9 double-hung.

-

Details: Trim is heavier, with bold lintels or cornices, and sometimes triple windows.

-

Symmetry: Very formal and aligned.

-

-

-

Gothic Revival (1840–1880)

-

-

-

-

Windows: Pointed arched or lancet windows.

-

Details: Often include tracery or leaded glass.

-

Unique Feature: Steep gables often include small attic windows with Gothic arch tops.

-

-

-

Italianate (1840–1885)

-

-

-

-

Windows: Tall and narrow, typically 2-over-2 double-hung.

-

Details: Frequently arched or curved at the top with elaborate hood molds or brackets.

-

-

-

Queen Anne / Victorian (1880–1910)

-

-

-

-

Windows: Mix of 1-over-1 sash, bay windows, and stained or leaded glass.

-

Details: Asymmetrical placement, curved or multi-faceted bays.

-

Ornamentation: Highly decorative, often with colored panes or etched glass.

-

-

-

Colonial Revival (1880–1955)

-

-

-

-

Windows: Double-hung sash with 6-over-6 or 8-over-8 panes.

-

Details: Return to Georgian symmetry and formality, often with shutters.

-

Palladian window usage is revived.

-

-

-

Tudor Revival (1890–1940)

-

-

-

-

Windows: Casement windows with diamond-pane leaded glass.

-

Details: Grouped in twos or threes, framed in dark wood or stone.

-

Bay or oriel windows common.

-

-

-

Craftsman / Bungalow (1905–1930)

-

-

-

-

Windows: Double-hung with 3-over-1 or 6-over-1 panes.

-

Details: Grouped in bands, simple wood trim.

-

Materials: Often wood, sometimes stained.

-

-

-

Prairie (1900–1920)

-

-

-

-

Windows: Horizontal bands of casement windows.

-

Details: Art glass or geometric patterns.

-

Style: Integrated with horizontal emphasis of the home.

-

-

-