Hard assets are tangible, physical assets that have intrinsic value. In investing, they are often used as a hedge against inflation, deflation, economic downturns, or currency fluctuations because they tend to hold their value over time.

Examples of Hard Assets:

-

-

-

- Real Estate – Residential, commercial, or industrial properties.

-

-

After the US went off the gold standard in 1971, middle class Americans have been encouraged to take out home equity loans to remodel their homes. This helped homeowners to leverage up their home debt and to make money while inflation the medium cost of house in 1971 from $25,000 to $4457,800 in 2024; this is a 1,731% increase.

-

-

-

- Precious Metals – Gold, silver, platinum, and other valuable metals.

-

-

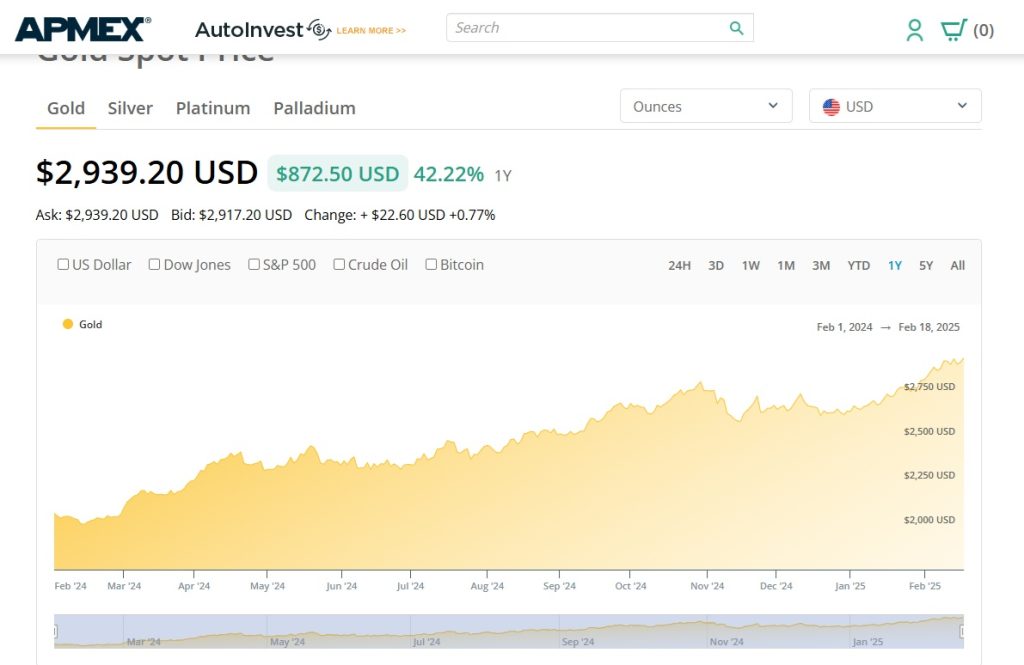

If the stock market goes up by 100%, and the US Dollar collapses 42% against gold, have you really made any money? The answer is no when you adjust for inflation.

-

-

-

- Collectibles – Art, rare coins, classic cars, vintage wines, and antiques.

-

-

A great hedge against inflation but can be expensive.

-

-

-

- Farmland & Timberland – Land used for agriculture or forestry.

-

-

A great hedge against inflation but most is owned by large corporations and individuals.

-

-

-

- Private equity in a small business.

-

-

It’s a great time to start a business. If you can make money in today’s world, you can make money anytime.

Why Invest in Hard Assets?

-

-

-

- Inflation Hedge – Hard assets often appreciate when inflation rises.

- Store of Value – They don’t lose value as easily as paper assets.

- Diversification – Helps balance a portfolio against stock market volatility.

- Intrinsic Demand – Many hard assets (like real estate and commodities) are essential for industries and economies.

-

-